- Welcome

- Managing Your Business Finances

Managing Your Business Finances

Aaron started an online side hustle. He would earn money from clients by creating graphics and websites. He loved what he did. But he frequently found himself overwhelmed and stressed out by the money involved.

Aaron is skilled in his profession. But he lacks the knowledge and understanding to manage his business finances.

Many entrepreneurs find themselves in a similar situation. They aren’t sure how to manage their business finances, and as a result, money becomes a constant source of stress rather than the blessing God intended it to be.

Fortunately, there are things you can do to learn to manage your money to honor God and allow you to rest easy, knowing that you’re a wise steward with the resources he’s given you.

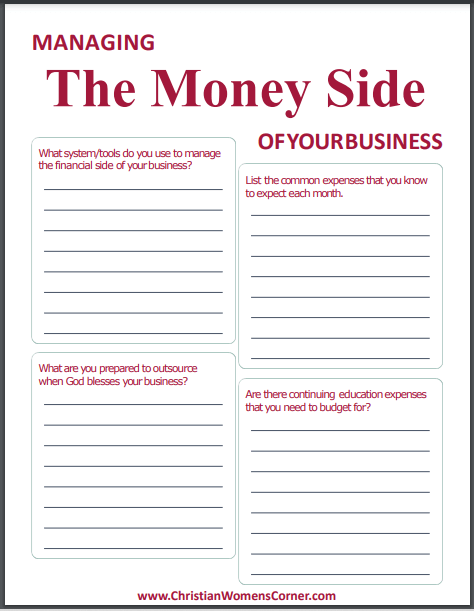

We have printable worksheets available to help you start managing the money side of your business. It includes guided questions that will trigger thoughts and ideas to help you create a well thought out plan. Click >>here<< for the worksheets.

Create a Business Budget

Many entrepreneurs experience money stress simply because they don’t have a business budget. They don’t know when expenses are due, let alone how much to estimate the cost.

But you don’t have to live this way anymore. It’s time to create a business budget and use that to guide your decisions.

Keep It Simple

The first rule of creating a business budget is to keep it simple. If you prefer spreadsheets, create your budget in a spreadsheet. If you find lists easier to manage, make a document with a list of items for your budget. The important thing is to pick a method of budgeting that you’ll remember to use.

Plan for Common Expenses

The first thing to do with your budget is to plan for common expenses. These are normal, everyday expenses that you know to expect each month. For example, your website and hosting are common expenses that you know will come due each month. Put them on your list.

Other common business expenses include software subscriptions, utilities such as internet or electricity, mailing list services, and office supplies.

Think Ahead to the New

As you’re creating your budget, make sure to create space for new software and hardware. Even with excellent care, your computer won’t last forever, and your software will eventually need to be updated to stay compatible.

Anticipate Continuing Education Expenses

There’s always something new to learn, and this is especially true for Christian entrepreneurs who strive to be up-to-date with industry standards. That means you need to budget for continuing education expenses.

Your continuing education may look different depending on your niche and the type of work you do. A continuing education expense for you might be getting certified in programming. In contrast, continuing education might look like attending a one-day seminar on a complex topic for an entrepreneurial friend.

Remember Outsourcing

A commonly overlooked item in the business budget is outsourcing expenses. You may be responsible for everything in the early days of building your business. But as God blesses your business, it’s common to have to bring in other team members. This could be in the form of a virtual assistant who works a few hours each week or a full-time employee who helps you manage your business.

Start budgeting toward this expense before you need to hire someone. Get comfortable regularly putting money aside for outsourcing. So, when it’s time to find someone, you can focus on getting the person that’s a good fit rather than how you’ll afford the help.

Create a Category for the Unexpected

Every business encounters the unexpected at some point. Maybe your website was infected with malware, and you’ll need to hire someone to handle cleaning it up. Perhaps your vendor didn’t come through, and now you have to find a new, pricier one.

These expenses certainly aren’t fun. But if you’re already prepared for them with a category for the “unexpected, “ they feel more like a bump in the road than a serious disaster.

Your Budget Will Change

Finally, it’s important to keep in mind that your budget is a living document. It’s not meant to be static. It will grow and change as your business finances do. You might need to budget more for outsourcing this year and less for continuing education. If that happens, simply adjust the numbers, and keep moving forward!

Understanding Your Profit Point

When building a successful business, you must understand your profit point. If you can’t accurately gauge whether a product or service will make you money, you may find yourself in a “feast or famine” cycle, meaning you might have amazing months of profits followed by lean months where there just isn’t enough to meet the bills. Smoothing out your cash inflow is essential, and here are a few ways you can do that…

Make No Assumptions

The biggest problem that entrepreneurs make when it comes to their business is assuming they’ll be working at optimum every day. For example, you manage to crank out ten thousand words today and think you’ll always be able to maintain that schedule. You create 30 new graphics for a client and believe you can do that every day.

Unfortunately, you won’t always be at optimum. There will be days when you haven’t slept well the night before, when you’re fighting the flu, or when your babysitter cancels, and you’re left to figure out childcare while balancing your client’s work.

Realize Not All Hours Are Billable

There are many hats you’ll most likely wear in your business, and it’s essential to understand that not all of them create billable work. For example, you spend an hour being interviewed on a podcast, writing a new blog post, or creating graphics for your social media presence.

While these tasks may indirectly lead to work, the truth is that you can’t bill a client for them. If you have 20 hours a week to dedicate to your business, half that number and assume that’s your billable time. Now think about what you would need to charge a client to make those 10 hours profitable.

Create Packages

Packages are a way of giving fair value to yourself and your clients. If you’ve been focused on hourly work, you need to give the idea of creating a package some serious thought.

Sarah was a virtual assistant that specialized in shopping cart setup. It took her ten hours to do the task when she first started, and she was paid by the hour. As her skills increased, it only took Sarah five hours each time. She was essentially getting paid less while her value had increased.

Sarah created a shopping cart installation package since she wanted to be paid fairly and the workman is worthy of his hire (Luke 10:7). She quoted her clients a flat-rate fee, and they loved it. They knew exactly what to expect and how much they would be charged.

Sarah loved it because even on the days she wasn’t working at optimum, she still made a fair wage and could afford to provide for her family.

You Learn as You Go

It’s not uncommon for new entrepreneurs to lose money on their first project or two. You’re still learning about how the business works and where your profit point is. But if you’re determined to push through that, find your profits, and thoroughly understand your business finances, then use the tips above to help!

Business Partnerships & Money

In any relationship, money can become a source of tension and division. But in Romans 12:18, Christians are called to live peacefully with others as much as possible.

Fortunately, most money problems can be resolved before they start. You and your business partner only need two things to accomplish this—clear communication and transparent boundaries. Here are some tips for creating both of those things…

Pick One Partner

One business partner should handle the money side of the business. Be honest about skills and gifts here. Some Christians are gifted with an incredible creative side, but they don’t know a thing about money management. Others are detailed and highly focused on business finances.

The one that God has gifted in this area should be the one that handles the business finances. If that’s you, then humbly accept this responsibility. If that’s not you, then acknowledge that God has blessed you in other ways.

Access for All

While one partner should be handling the money, the truth is that all partners should have equal access to the financial accounts. This includes any information related to checking, savings, or online accounts.

The purpose of this is two-fold. First, it creates transparency and accountability for the one managing the money. Second, it ensures that if the money manager is unable to complete their duties, the other business partner can carry the load or outsource this task.

Regularly Discuss Money

At the very least, business partners should gather once a month to discuss the state of the business finances. Sometimes, this might be a very brief meeting because everything is flowing as usual. Other times such as during tax season, you may find yourself discussing the money more in-depth.

Set a Spending Threshold

Dan wanted to be transparent about business finances with his partners. So he would text them whenever he spent money on the company cards. After a while, Dan’s partners told him not to update them on small things like buying paperclips.

Instead, they encouraged Dan to communicate any time a business expense was over $100. This created freedom so that Dan could spend without worrying. But also gave him the chance to check in when the expense was larger.

Like Dan and his business partners, setting a spending threshold is wise. This can be an amount that one partner can comfortably spend without talking to the others or needing approval. However, anything over the threshold should be discussed in advance.

It’s important to understand that this amount will differ depending on the size of your business and how large your profits are. A small online business may only need a $50 threshold, while a much larger company will require a considerably higher amount.

Partnerships Honor God

When a business partnership is flowing, and all partners are in harmony, it’s a beautiful testimony that honors God. This doesn’t mean that you always agree on everything, but it does mean that you practice transparency and treat one another with respect.

When to Hire a Bookkeeper

Business finances aren’t always easy. They can be downright stressful and overwhelming. That’s why some entrepreneurs choose to hire a bookkeeper. But how do you know if it’s the right decision for your business? Here are a few signs you need to outsource the financial management…

Sign #1: You Never Update Your Books

Usually, a failure to stay up-to-date with the business finances stems from one of two places. First, you really hate dealing with the numbers. Maybe you don’t enjoy math, or you’ve always preferred creative activities. Perhaps you simply loathe administrative jobs. If this is the case, you’re better off hiring someone than letting this task continually drain your joy.

The second reason some entrepreneurs don’t update their books is that they lack the time. This often follows a business growth spurt. While the blessing is enjoyable, it can create less time to focus on the administrative tasks that keep your business running efficiently. In this case, it’s also a smart idea to bring on a bookkeeper.

Sign #2: Tax Time Is a Nightmare

You’re not sure what your net profit is. You don’t know which deductions will work best for your business. You’re always behind on filing and asking for extensions, creating constant stress and frustration.

It’s OK to acknowledge that dealing with taxes isn’t your strong suit. Call in a bookkeeper and a tax expert. Not only will you feel better about your business finances, but you’ll be able to focus more efficiently on the tasks where you shine (like serving your clients or creating new products).

Sign #3: You Don’t Follow Up on Invoices

Another common sign that it’s time for a bookkeeper is that you don’t follow up on invoices. This could be due to being busy so that you forget to check which clients have paid you recently. It could also be due to a confidence issue in that you don’t want to rock the boat with a problematic client.

But not following up on invoices can create long-term cashflow problems that keep you up at night. If you hate handling the invoices, hire a bookkeeper to track your accounts payable and make sure that you’re collecting all of your hard-won earnings.

Ask for Recommendations

One thing that holds many Christian entrepreneurs back from hiring a bookkeeper is that they don’t know who to get for the job. Instead of letting this stop you, ask around to some of your entrepreneurial friends.

The chances are high that someone can point you in the direction of a professional who is ethical and efficient with business finances!

Creating a Money Cushion

Money flow can be unpredictable when you run your own business. A long-term client can suddenly decide he doesn’t need your services anymore. A product that was sure to be a hit fails due to the changing market. A promotion that you thought would bring in new clients doesn’t cause anyone to knock on your door.

These moments can be discouraging, and when you’re running a business, they can also be worrisome. Rather than waiting for the moments to happen, look to create a “money cushion” in your business finances. This is extra cash that you’ve set aside specifically for a slow month, and it can keep you afloat until more work comes along. Here’s how to create your money cushion in just a few simple steps…

Start with a Small Amount

When you’re in a pinch, every dollar counts. So while setting aside a small amount such as $5 or $10 may seem silly, the truth is that it can be a huge blessing when you are in a crunch.

It can also create momentum as a small savings fund grows from $5 to $50 to $500 or more. The more progress you make, the more you’ll be encouraged to continue saving.

Use a Percentage

For some business owners, their income is unpredictable. You might want to set aside $200 this month but only have $50 due to a project that fell through. This is natural and doesn’t mean you’re on the wrong track.

If you have a variable income, try setting aside a percentage of each paycheck for your savings. A good starting point is ten percent, but you can adjust that depending on your expenses and savings goal.

Keep It Accessible

You want your money cushion to be accessible to get to it if you need it. But you don’t want it so accessible that you’re likely to spend it all on an impulse purchase or a seeming emergency that genuinely isn’t one.

Many entrepreneurs find it helpful to have a savings account with a cushion at a different bank than they usually use. This prevents them from accidentally spending their savings, and it means they’ll have to consider whether the expense is a true emergency before they spend the money.

Replace Your Cushion

The moment you know it’s time to use your cushion, start thinking of ways to replace it. Could you run a retirement sale on one of your old products? Could you take on an extra project from your favorite client? Could you sell something in your household that’s not being used?

Look to recreate your cushion as quickly as possible. This will help you in the future, but it also gives you an idea of what you can accomplish when you hustle.

Your cash cushion is there to be used. Don’t feel guilty or ashamed when you have a slow month and have to dip into it. Just make a plan to replace it and carry on.

Preparing for Tax Season

If tax season normally stresses you out, you should know it doesn’t have to be this way. You can do things to prepare for tax season so it’s as painless as possible. Here’s what to do…

Prepare All Year Round

The first and most important key is to keep your books up to date all year round. This ensures that you get the best deductions and benefits. If you can’t keep your books updated yourself, then look to hire a bookkeeper.

Know Your Tax Deadlines

Your tax deadlines will differ depending on what country you live in. But your deadlines can also vary depending on how your business is classified and whether you have business partners.

Learn about Deductions

Spend some time learning about common business deductions. You may be aware of key deductions that can save you a lot. These deductions include mileage to business events, office space, business meals, and even childcare.

Get a Tax Consultant

If you’re confused about filing taxes or think you’re leaving money on the table, don’t try to do it yourself. Find a tax consultant to help you. This can prevent costly tax mistakes and makes it less likely that you’ll be audited in the future.

Pay Your Taxes Faithfully

In Mark 12, Jesus was asked about taxes and responded,

17“Give back to Caesar what is Caesar’s and to God what is God’s.” (Mark 12:17)

In other words, paying taxes is not optional for a Christian. It’s a Biblical command and shows our obedience and submission to God.

It’s a poor testimony for a Christian to refuse to pay taxes. Indeed, there are situations and times when you might be late on paying yours, and you may even need a payment plan. There’s no shame in that as long as you seek to pay what you rightfully owe.

Be a Wise Steward

Managing business finances isn’t really about how much you make or don’t make. God is your Provider, and He can supply you with everything you need (Philippians 4:19).

Instead, managing your financial affairs wisely is about being a good steward and honoring God with the resources He has blessed you with.

Grace and peace,

Alicia

Free Downloads

Whew! You made it to the bottom of this blog post. I appreciate you taking the time out of your busy day to read what was on my heart. I'd like to thank you by offering two free PDF downloads when you fill out the form below.

Make sure to click the box beside 'Subscribe to the CWC Email Community' to receive our monthly newsletter and a few emails a month to keep you informed about our community, updates on the website, and to send you cool free stuff!

The first is a workbook that goes deeper into growing your business with outsourcing. It includes guided questions and places for notes.

The second is a checklist that contains tips, ideas and suggestions about outsourcing and how to do it well.

You can read the PDF downloads on whatever electronic device you use and fill out the workbook answers in your own notebook.

Another way to enjoy the downloads is to print them out on your home printer or email them to your favorite printer like the UPS Store, Staples Business Depot, or Kinkos and use them in printed form.

Your information is 100% private & never shared.